In deciding that we were going to cut out all the non-necessities from our budget as a way to sacrifice.

We had a long discussion about our Costco membership. The nearest Costco is about 65 miles from our home. So going has to be a planned and calculated choice. Is a Costco membership really worth it for us when we live so far and can go so infrequently?

We travel to Phoenix about every other month to visit my family, have my siblings see their cousins, pick up our bread, attend the Temple as part of our religious commitments, and to go to Costco. So is having a membership going to be worth it to us.

Math- we started with a list of what we buy and what the cost of starting to buy those at the grocery store (or online) would be and the cost verse buying them at Costco. In Oats and peanut butter alone our Costco membership is paid for in a year.

So we determined that the membership is not worth taking off our budget as a sacrifice (and it would be a sacrifice, I love shopping at Costco). We did discus canceling the membership and having someone purchase gift cards* for us any time we needed to go, but our past experience trying to get family in friends to do errands for us before we come up to town haven't worked very well and relaying on that we'd have what we need and when would not be a smart idea considering our tight windows.

*$ saving tip- you don't needed a membership card to go shopping at Costco, a Costco gift card will do

What do I buy at Costco?

first off great resource- QueenBeenCoupon's Costco price list or Pratical-Stewardship's list

Prices at Costco change all the time, but this is a good place to check when you're debating if that item at the store is a better deal than Costco or the other way around. This list of what I buy is always being evaluated and changing. Sometimes these items are even on the Costco which makes them even more of an awesome deal

Now because I do once a month shopping and I'm not running into the store to grab the best deal every time it goes on sale there are things I buy at Costco because the every day price there is cheaper then the everyday grocery store price, and doing the coupons, price matching, and running around isn't worth it to me. If I happen to be at the store when they are on sale- awesome I'll pick it at there, but otherwise it is Costco:

What I don't buy at Costco:

What are your must buys or stay-away products at Costco?

We had a long discussion about our Costco membership. The nearest Costco is about 65 miles from our home. So going has to be a planned and calculated choice. Is a Costco membership really worth it for us when we live so far and can go so infrequently?

We travel to Phoenix about every other month to visit my family, have my siblings see their cousins, pick up our bread, attend the Temple as part of our religious commitments, and to go to Costco. So is having a membership going to be worth it to us.

Math- we started with a list of what we buy and what the cost of starting to buy those at the grocery store (or online) would be and the cost verse buying them at Costco. In Oats and peanut butter alone our Costco membership is paid for in a year.

So we determined that the membership is not worth taking off our budget as a sacrifice (and it would be a sacrifice, I love shopping at Costco). We did discus canceling the membership and having someone purchase gift cards* for us any time we needed to go, but our past experience trying to get family in friends to do errands for us before we come up to town haven't worked very well and relaying on that we'd have what we need and when would not be a smart idea considering our tight windows.

*$ saving tip- you don't needed a membership card to go shopping at Costco, a Costco gift card will do

What do I buy at Costco?

first off great resource- QueenBeenCoupon's Costco price list or Pratical-Stewardship's list

Prices at Costco change all the time, but this is a good place to check when you're debating if that item at the store is a better deal than Costco or the other way around. This list of what I buy is always being evaluated and changing. Sometimes these items are even on the Costco which makes them even more of an awesome deal

- Quaker Oats 10 lb total (2 bags) are $7.99 box = .80 per lb compare to the best price I have EVER got on the 42 oz canisters is .95 per lb- and that is Costco's everyday price- you can't beat it.

- Peanut Butter the 2 packs of the 48 oz =.10 per oz the grocery store brand in the cheapest per ounce of peanut butter is .12 per oz on sale.

- Whole Rotisserie chickens ~3lbs= 4.99 (1.66 per lb) these are huge, ready to eat, and I normally make it stretch it for at least three meals. Also great for when you are going to get home late from doing the shopping or on vacation- run into a Costco instead of fast food for your family.

- Vlasic 1 Gallon Pickle jars- 1 jar ~$4.90 that is the same price as the small jars at my local grocery store.

- Whole Almonds- $15.99 for a 3 lb bad. I love almonds and substitute them for pecans or walnuts (since I can't eat those) in every recipe, this is $5.23 per lb, at the grocery I can easily pay $7 for less than a pound of shelled almonds.

- Chocolate Chips- $9.99 for 72 oz. an 11 oz bag at the grocery store has to be $1.50 or less to beat that price.

- Baby Carrots- we eat baby carrots almost every day at our house. As snacks with meals, yes if you don't eat carrots they will go bad and are not a good deal for you. But compared to the grocery store price about $1 per pound at its very best these 5lb bags of carrots come in at .98 per lb. If you like the pre-bags carrots, come home and split some of the bag into snack bags/containers. Without carrots we end up eating processed chips- which would you rather have your family eating. I buy at least 2 every time I'm at Costco, sometimes 3.

Now because I do once a month shopping and I'm not running into the store to grab the best deal every time it goes on sale there are things I buy at Costco because the every day price there is cheaper then the everyday grocery store price, and doing the coupons, price matching, and running around isn't worth it to me. If I happen to be at the store when they are on sale- awesome I'll pick it at there, but otherwise it is Costco:

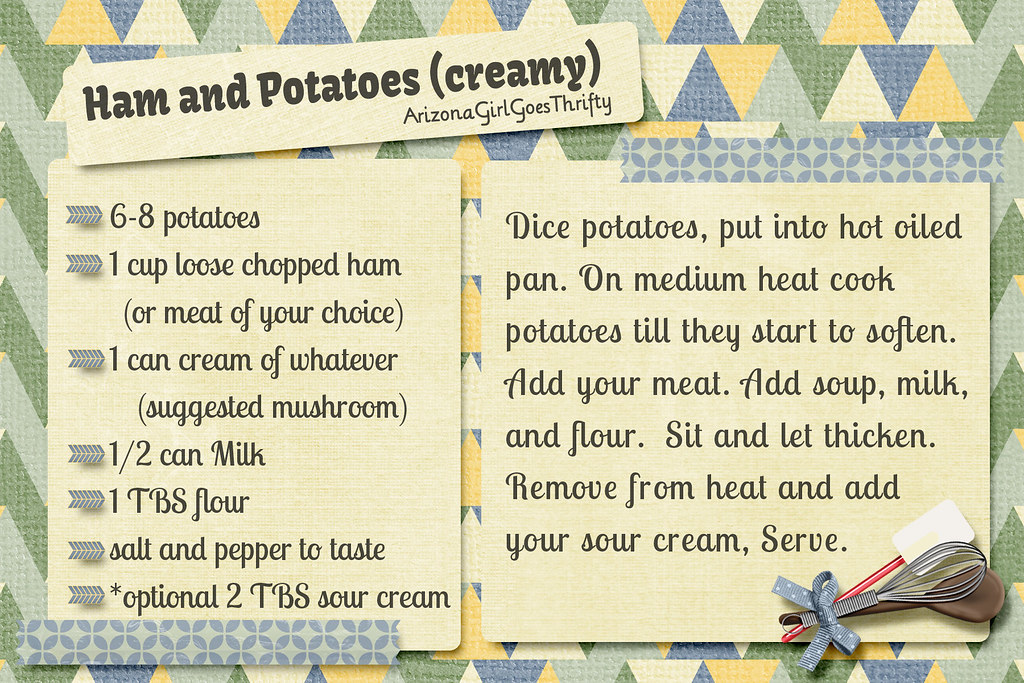

- Ham- There pre-cut extra lean ham it comes in 1.5 lbs 2 packs for around $10

- Eggs- 5 dozen, if I can going home to my house and not traveling these bulk packs are cheaper then the local grocery store when they are not on sale. Lately eggs haven't been on sale much.

- Frozen Veggies- The quality is better than the grocery story's and if the grocery story isn't having a good deal they are about the same price.

- Cream of Mushroom Soup- yes I know, making it myself is cheaper. I'm a little intimidated that it will change the taste too much to use homemade versions. So if you're lazy like me =.89 per can, butter price then anything that isn't a lot sale at the grocery store.

- Yogurt- its on coupon at Costco a lot, and unless the local store has a super 20/$10 sale, Costco is typically cheaper

- Apple Sauce- the jars come in packs of 4 averaging $2 per jar. That is a typical sale price for the same size jar.

- Flour- 25 lb bag for 7.99 that is about .32 per lb of flour. If you bake a lot this is a great deal

- Sugar- 25 lb bag for 10.79 that is .43 per lb of sugar. If you do a lot of baking!

- Fresh Spinach bags- - Fantastic deal but you have to have a game plan to make this happen. You'll have about 2 weeks from leaving the store. Planned meals with Spinach (my husband loves it for lunch salads) good news it you can freeze what you don't get to in time.

- Computer paper

- Printer Ink

- Tortillas

- Minced Garlic

- Otter pops- these are only available seasonally, they come 80 in a box and are a great price. I found them once at the grocery story for about the same price for 100 and thought I was getting a way better deal until I realized that the Costco otter pops are the 2 ounce pops and the grocery store are 1 ounce pops. Take your pick on what you value- if you're giving pops to 100 kids at a summer camp doing the smaller ones at 100 pops might be the better deal for you.

- Fruit Snacks- when I'm not making my own and when these are on coupon, it is a good price for fruit snacks and the ones at Costco have more nutritional value then the cheap ones at the grocery store.

- Yeast- when I am doing a lot of pizza, bread, and dough making I go through a lot of yeast. I go through those packets at the grocery store so fast and the Costco yeast is worth it. So if I'm buying yeast at Costco I am making a commitment to use it regularly and not get lazy on my dough making.

What I don't buy at Costco:

- Animal Crackers- I love to eat them, I love to use the canisters afterwards for storing all the other bulk items I buy at Costco- but $9 for 64 oz. I have found my kids love the super cheap animal Crackers that are $1 for 1 lb from our local grocery store.

- BBQ sauce- yes there are some fun and tasty BBQ sauce at Costco, but every time I've done the numbers I am over paying even everyday prices at my local grocery store.

- Hot Dog packages- Even when on coupon it always feels there are better deals at my local grocery story

- Meats in general- I travel a way to get to the Costco- my meats have to survive the drive in freezer bags, in addition, they are never that great of prices. Yes they are around the average price at the grocery, but it is one of those items that I can regularly get cheaper at the grocery story- if I am willing to buy the meat and cuts that are on sale that week. Now if you want a specific cut or type of meat for a special occasion then this is a reasonable deal for not overspending on it. Example for me is Lamb- lamb is expensive but there are a couple times of year I like to make lamb for special occasions. If I buy it at my local grocer then I will pay about $10 per lb. I can similar cuts for around $5.50 per lb. Still more then my goal per lb cost for meat in general but it is for a special occasion.

- Soda/pop- if you are a Soda drinker of more than a can a day, this might be a good deal for you, but even when discounted at Costco they are still more per can then I would ever spend on it at the grocery store. My purchase price for soda has be to cheaper than .20 per can, Costco comes close sometimes, but not to my purchase point.

What are your must buys or stay-away products at Costco?

.png)